Investing is a key aspect of financial planning, and individuals often grapple with deciding where to allocate their funds. The stock market is a popular choice for potential high returns, but the risks associated can be intimidating. In contrast, leaving money in a bank account seems safer. This article explores the factors to consider when deciding between the stock market and saving in the bank, addressing concerns about the perceived high risk associated with the stock market.

Understanding The Fear

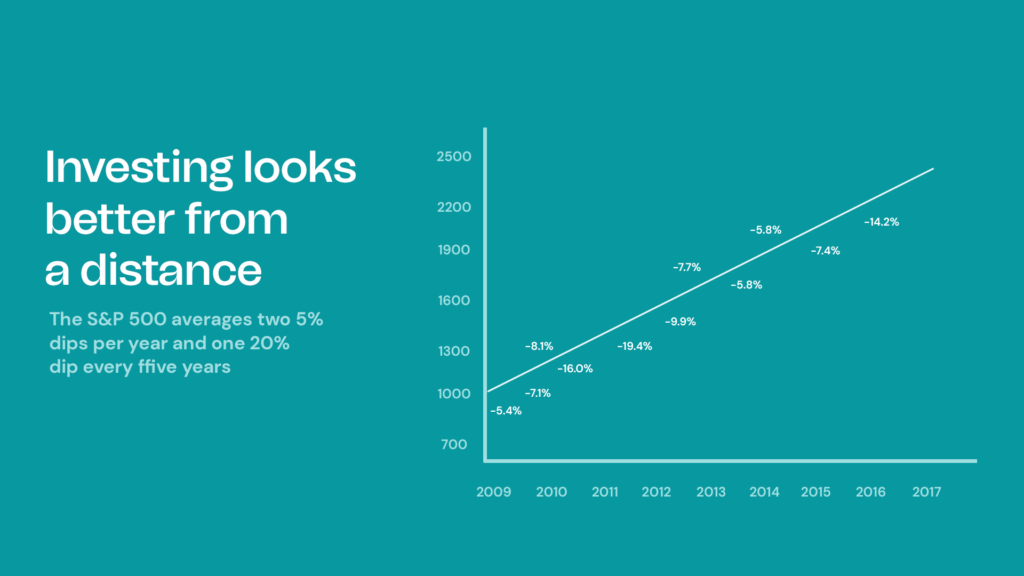

The stock market is often viewed as high-risk due to its inherent volatility. Prices of stocks can fluctuate rapidly based on various factors, including economic conditions, geopolitical events, and company performance. These fluctuations can lead to both substantial gains and significant losses. For example, in 2009, the U.S. stock market, as measured by major indices such as the S&P 500 and Dow Jones Industrial Average, experienced a sharp decline. The S&P 500 lost about 57% of its value from its peak in October 2007 to its trough in March 2009, representing one of the most substantial market downturns in recent history.

We also live in a time when financial news is readily accessible, accompanied by ads and finance analysts who amplify concerns about an impending market collapse. Investors can easily hear claims of a significant downturn, which can trigger anxiety and apprehension among them. It is important to recognise that fearmongers have existed throughout history, especially during market highs and lows. However, their track record in accurately predicting downturns is notably poor, as evidenced by past economic crises like the 2008 recession, the bursting of the 2000 tech bubble, and the Great Depression.

But Is Putting Money in the Bank Worth it?

While the stock market carries a level of risk, it is essential to understand that risk is an inherent part of any investment. Leaving money in a bank, typically in the form of savings accounts or certificates of deposit (CDs), may seem like a safer option, but it comes with its own risks. Interest rates are incredibly low, and you’ll probably make less than 4% per annum in a savings account. Additionally, you’ll have to contend with inflation and devaluation, which could affect your buying power as your money sits idly in the bank.

So What are We Saying?

While recognising the unpredictability of the financial markets, it is essential to acknowledge the possibility of downturns, recessions, or even a depression. Our advice to investors has always been: expect rough patches in the market, don’t be surprised by them, and stick to your plan. But we also know it’s hard not to panic when the market moves erratically.

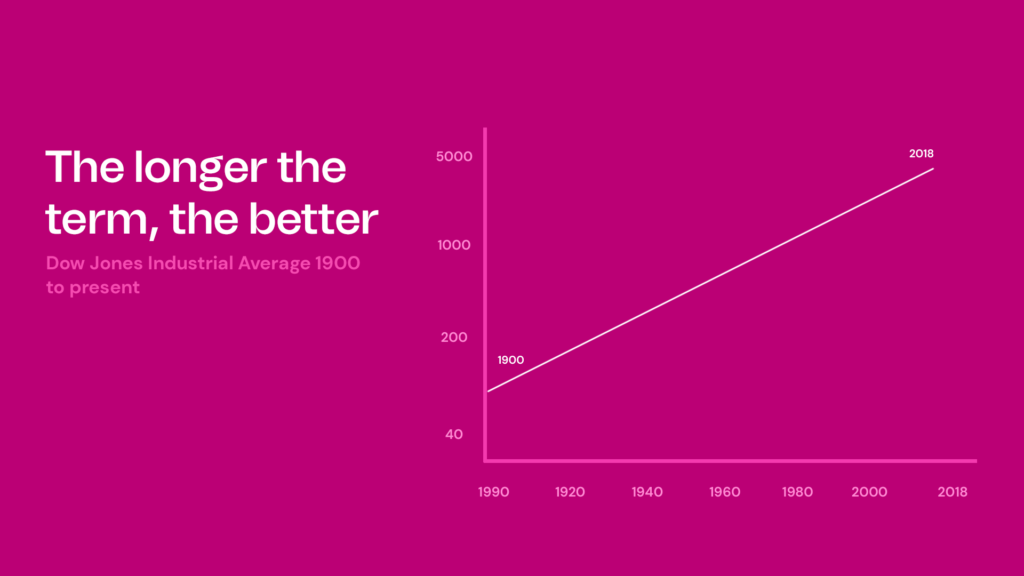

However, a crucial aspect to consider is the historical trend that, over time, the stock market tends to grow in line with the economy’s growth and wages. While this is not a guarantee for the future, historical patterns suggest that, on a longer-term horizon, the market has displayed a propensity to recover and thrive.

Downturns are healthy for long-term investors. When the market experiences a pullback, it provides opportunities for long-term investors to buy shares in robust companies at a less expensive price. And over the long term, it corrects itself to reflect changes in the economy and fortunes of certain companies or sectors.

Maintaining a Long-Term Perspective

Investment accounts are for longer-term investments, and the key to navigating the uncertainties of the stock market includes maintaining a level-headed, long-term perspective.

At Risevest, we encourage investors to be committed to investing for a minimum of three years because the markets have a good probability of performing well over that period. As Warren Buffett says: “Why scrap an informed decision because of an uninformed guess?” Don’t panic because you think you’ll know what will happen next week — stay in because you know what will happen in the long term.

Why? Because markets, in the long term, have proved to be quite predictable. Check out this depiction of the last hundred years of the Dow Jones Industrial Average.

In conclusion, the decision to leave money in the bank or invest in the stock market is a nuanced one that requires careful consideration. While fears of market volatility and predictions of significant downturns abound, historical evidence suggests that the market has shown resilience over time. By maintaining a balanced perspective, acknowledging the possibility of downturns, and focusing on long-term goals, investors can make informed decisions that align with their financial objectives.