It’s the second quarter of 2021 and a lot of public companies in the US are reporting on their quarterly earnings. From Facebook to Apple and from Pinterest to Google, they all reported earnings that beat the expectations of analysts. And this even got the whole of FinTwit wondering if the big tech companies will ever slow down on their growth trajectory.

But you know what? Despite all the record-beating earnings, most of these stocks traded below their previous day’s closing price. That makes you ask and wonder what indeed moves a stock price upward if it’s not record-breaking earnings.

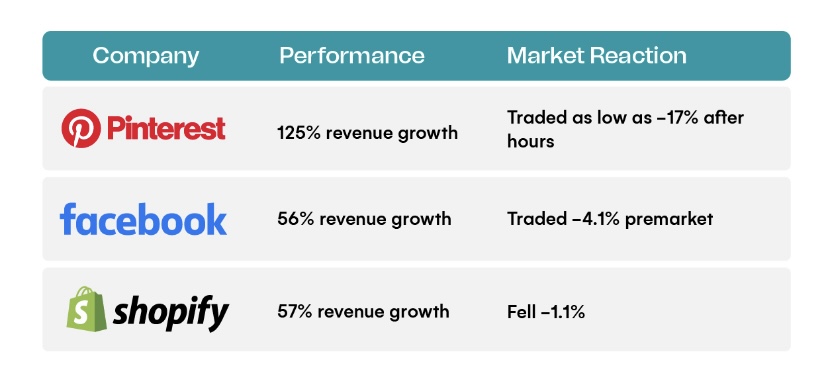

Can you see the pattern here and there? Companies report record-breaking earnings and their stocks falling (albeit temporarily).

Granted, when you look under the hood enough, you will find a reason to explain this phenomenon. But that’s the point, in the short term, there’s a lot of irrationalities. It takes time for the true picture to reveal itself.

Assuming you are a day trader who bets on revenue numbers to make your trades, you’d have lost your money to the market’s unpredictable behaviour. Or perhaps you buy stocks yourself without much understanding, you would have wondered why the stock price was falling despite the good earnings report.

They are falling based on short-term information that some people are not comfortable with. And at best those pieces of information are our opportunity to buy the stock at a cheaper price and at worst, merely noise to be ignored. Learn to ignore the noise.

Given a long enough time, quality companies will thrive and return great ROI. See how Amazon has performed over the years. In the history of Amazon, it has suffered as much as 80% price decline, many 30% declines, and too many 10% declines. Yet, even someone who invested in it just at the beginning of this year would have raked in a whopping 13% ROI by now. And those that invested since 5 years ago would be up by 370%.

With this knowledge, here’s my simple advice, borrowed from Charlie Munger, “never interrupt compounding”.

When investing, the most important metric is your compounded annual growth rate (CAGR). That is your return over your entire holding period (2, 5, 10, 20, or more years). The return you make in any given year is great but since the money is still invested, you need to ensure that you allow it to continue to grow.

How can you interrupt compounding?

You interrupt compounding when you stop investing on schedule or you liquidate your investment for fear of the unknown.

Whatever your investing schedule is, stick to it or improve it. Never interrupt it by stopping it. And whatever may happen in the market, don’t fret. Don’t stop investing out of emotion. It is the nature of the market that you experience volatility, it’s part of what you signed up for. Just trust that you are in a safe hand with Risevest and we will help you navigate through it.

So learn to ignore the noise because there would be a lot of it but focus your attention on ensuring you do not interrupt compounding.